Running a company in the Garden State comes with energy, opportunity, and plenty of surprises, which is why insurance for small business NJ has become a must-have safety shield. One unexpected accident can drain your budget and disrupt growth, so smart owners choose coverage that protects their hard work, employees, and customers. Whether you’re launching a startup or managing a growing shop, understanding New Jersey’s rules helps you stay compliant and confident.

Policies like small business insurance NJ, New Jersey business insurance, general liability insurance NJ, and workers’ compensation insurance NJ give you financial protection when the unexpected hits. With the right plan, you stay focused on running your business, not chasing risks.

Why Every New Jersey Business Needs Insurance No Matter the Size

Running a company without insurance exposes you to huge risks. Even a small accident can turn into a lawsuit, and New Jersey courts are known to take slip-and-fall claims and bodily injury claims very seriously. Many companies go bankrupt after one accident because the legal fees and property damage coverage costs are high. Insurance gives you business lawsuit protection, financial loss protection, and peace of mind. As 40% of businesses never reopen after a disaster, protection becomes even more important for long-term survival.

Experts such as Andrew Harris from Liberty Insurance and organizations like the Small Business Administration (SBA) and SCORE always advise new owners to secure coverage before taking their first customer. New Jersey also has strict rules through the NJ Department of Banking and Insurance, and failing to follow New Jersey small business requirements may lead to penalties.

What Is Small Business Insurance? Simple Explanation + NJ Requirements

Small business insurance is a package of policies that protect your company from accidents, injuries, property loss, and lawsuits. It includes coverage for customers, employees, vehicles, buildings, and online risks. In New Jersey, several protections are part of New Jersey insurance requirements, and missing them can cost you more later.

Many business owners ask: do LLCs need insurance in New Jersey? The answer is yes. Even though an LLC offers limited liability, it does not protect against claims involving negligence, property damage, or injuries. The state also requires workers’ compensation insurance NJ for any business with employees, and it enforces strict workers’ compensation penalties in NJ for violations.

What Is General Liability Insurance & How It Protects You

General liability insurance is the foundation of Garden State business insurance because it protects you from most accidents involving customers and property. It covers legal fees and payouts if someone claims you caused injury, damage, or harm. Nearly every industry needs this because New Jersey is a high-traffic, high-interaction state where risks are common.

This protection also covers advertising injuries such as defamation, which helps reduce reputational harm insurance risks. Many service companies, freelancers, and contractors rely on this coverage as part of insurance for service-based businesses and insurance for contractors and consultants.

Mandatory vs. Optional Business Insurance in New Jersey

Some policies are legally required. Others are optional but strongly recommended. Mandatory coverage includes workers’ compensation insurance NJ, commercial auto insurance New Jersey, and insurance required by New Jersey contractor bonds or surety bonds for contractors depending on the industry. These laws are part of mandatory business insurance in NJ and are closely monitored by state agencies.

Optional policies include professional liability insurance NJ, errors and omissions insurance NJ, commercial property insurance NJ, cyber liability insurance for small business, and business interruption insurance. These add more protection and help you meet New Jersey business compliance standards.

Full Coverage Breakdown: What General Liability Insurance Covers

General liability policy protects your company in several ways. It includes medical payments for injuries, legal defense, and property damage coverage. If someone trips over equipment or your business damages a client’s property, this insurance covers the costs. It also covers business vehicle accident costs when combined with hired and non-owned auto coverage.

Many owners see it as financial protection against disasters, and coverage applies to many industries including retail, restaurants, contractors, and consultants.

What General Liability Insurance Does NOT Cover Important Exclusions

Some events are outside this policy. It does not cover employee injuries, so you still need workers’ compensation. It does not include cyber attacks, data theft, or cyber attack costs, which means you must add cyber liability insurance for small business. It also excludes professional mistakes, which require medical malpractice insurance, professional liability insurance NJ, or errors and omissions insurance NJ depending on your work.

General liability also does not cover equipment failure, so many companies add equipment breakdown insurance for full protection.

Who Needs General Liability Insurance? Industry-Wise Breakdown

Any company interacting with customers, equipment, vehicles, or property needs this policy. This includes construction, retail, healthcare, hospitality, and online businesses. It also protects freelancers, consultants, real estate agents, and therapists. Many industries cannot get contracts without showing proof of insurance or fast certificate of insurance delivery.

Contractors, restaurants, and service experts need additional protections like liquor liability for restaurants, New Jersey contractor bonds, and workers’ compensation for independent contractors New Jersey.

Extra Policies NJ Businesses Often Need Complete Protection Stack

Owners who want full protection often choose a business owner’s policy (BOP) because it combines liability, property, and business interruption into one package. Adding commercial umbrella insurance increases your protection limits. Many companies also add business interruption and income loss coverage to survive shutdowns.

Online companies add cyber insurance because cyber breach average cost $140,000, and New Jersey has strong data laws. More advanced options include reputational harm insurance, equipment breakdown insurance, and industry-specific policies.

How Much NJ Business Insurance Costs Price Ranges + Cost Drivers

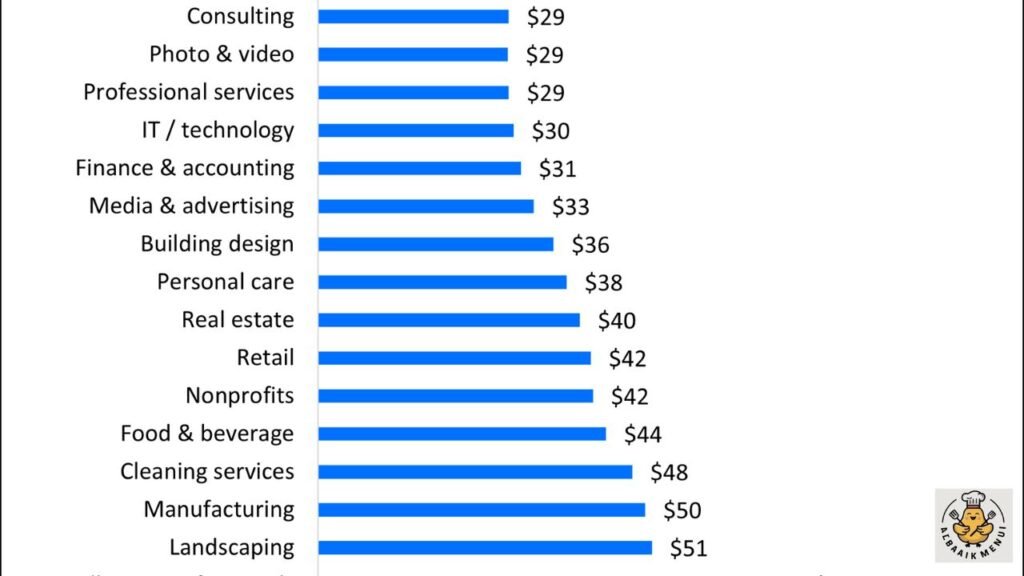

Insurance prices vary based on size, location, industry, and risk. The table below shows typical costs for New Jersey companies. These numbers come from common business insurance premium factors, workers’ comp premium rates, and local trends.

| Coverage Type | Typical Monthly Cost | Influencing Factors |

| General Liability | General liability cost per month varies from $45 to $95 | Industry, claims, location |

| Workers’ Compensation | $80 to $145 | Payroll, risk class |

| Commercial Auto | $110 to $190 | Driving history, vehicle use |

| Professional Liability | $45 to $120 | Experience, claims |

| BOP | $70 to $140 | Property value, operations |

Many owners worry about how much does small business insurance cost, but the price is lower for companies with safety program discounts, training programs, and fewer claims. Careful planning and money-saving insurance tips help lower the final price.

How to Get Business Insurance Fast Step-By-Step Guide

Learning how to get small business insurance in NJ is simple. Start by reviewing your risks, then choose your required coverage based on NJ commercial insurance requirements. Get quotes from multiple providers, compare limits, check reviews, and confirm compliance with New Jersey business compliance rules. Many owners also check options through HealthCare.gov, New Jersey SBDC, and local brokers to learn where to buy business insurance in NJ.

Once approved, your insurer will guide you on how to get a certificate of insurance quickly and explain how to file an insurance claim if anything goes wrong. This process helps ensure business continuity and financial security for the long term.

FAQS

What type of insurance do I need for a small business?

Most small businesses need general liability insurance, workers’ compensation (if you have employees), commercial property insurance, and professional liability depending on the industry.

Does NJ require business insurance?

Yes. New Jersey requires workers’ compensation for any business with employees and commercial auto insurance for any business-owned vehicle.

How much does $1,000,000 general liability insurance cost?

A $1,000,000 general liability policy usually costs $45–$95 per month for small businesses, depending on industry and risk.

What insurance do you need for a small business?

At minimum, general liability insurance plus any required coverage like workers’ comp, commercial auto, or professional liability if you offer services.

How much should small business insurance cost?

Most small businesses in NJ pay between $600–$2,500 per year depending on size, industry, location, and coverage needs.