A strong business insurance guide helps every small business owner understand real risks and choose the right protection before trouble shows up. When you run a business, you face threats like lawsuits, property loss, cyberattacks, and unexpected accidents, so you need clear tips, reliable info, and trusted resources to stay safe. This guide walks you through the essentials in simple language, so you can avoid big mistakes and make smarter decisions. You’ll learn how different policies work, how to compare plans, and when coverage becomes essential for long-term stability. With the right business insurance coverage, liability protection, commercial insurance, business risk protection, and insurance requirements for businesses, you can build a safer future for your company.

What Is Small Business Insurance and Why Does It Matter?

Small business insurance is a group of business insurance policies that protect your business from claims related to bodily injury liability, property damage claims, lawsuits and settlements, and unexpected accidents. Every business—no matter the size—faces financial risks. Without proper liability protection, even one lawsuit can destroy years of hard work. Many coverages help you pay for legal defense costs, repairs, medical bills, and income loss during disasters.

It matters because many states have legally required insurance rules that follow state insurance laws, especially for workers’ compensation requirements. Insurance also protects your corporate veil so your personal savings stay safe. A strong insurance plan strengthens your business continuity plan and disaster recovery plan, helping you get back to work fast.

Who Needs Small Business Insurance? (LLCs, Sole Proprietors, Startups & More)

Every business needs protection. Whether you run an LLC, a home-based shop, a startup, or a growing company, risks always exist. LLC insurance requirements still apply because an LLC structure does not fully protect you from all business lawsuits. Startups especially need insurance because startup insurance needs include equipment, customer injuries, and online threats.

Many industries have industry-specific insurance rules, and every employer must understand employee-related exposures, especially employee-related risks and workplace safety needs. The simple truth is that insurance is not optional when you want business assets protection and long-term stability.

Essential Types of Small Business Insurance

There are many forms of commercial insurance, and each protects a different part of your business. The most common types of business insurance offer financial support when disasters strike. Choosing the right mix depends on risk assessment, risk evaluation, and your operations.

The right coverage protects your equipment, property, employees, and finances. Your goal is to build protection that supports business growth and keeps business continuity strong even during emergencies.

General Liability Insurance (Do You Really Need It?)

General liability insurance is the foundation of commercial insurance because it protects you from bodily injury liability, customer accidents, and property damage. It also covers claims about reputation harm or advertising issues. Most businesses cannot operate safely without this protection. Even a simple slip-and-fall case may become costly.

This coverage is often the first policy clients or landlords ask for because it helps you handle legal defense costs and lawsuits and settlements. It is usually part of a business owner’s policy (BOP) and is essential for long-term business risk protection.

Commercial Property Insurance (Protect Your Workspace & Assets)

Commercial property insurance protects buildings, equipment, inventory, furniture, and all other business assets protection items. If fire, theft, storms, or vandalism occur, this coverage pays for repairs or replacements. It is a key part of your business continuity plan.

This insurance matters even if you rent your workspace because landlords rarely pay for your losses. It also supports a strong disaster recovery plan, helping you return to operations quickly.

Business Owner’s Policy (BOP): Are You Eligible?

A business owner’s policy (BOP) combines general liability, commercial property insurance, and business income insurance into a single package. It is designed for small to midsize businesses that meet BOP eligibility guidelines.

BOPs reduce insurance premiums because you get bundled insurance policies rather than buying each one separately. Eligibility depends on size, revenue, claims history, and operations.

Workers’ Compensation Insurance (Legal Requirements & Benefits)

Most states require employers to carry workers’ compensation insurance because it covers medical bills and lost wages after workplace accidents. It protects both the employer and employees under mandatory business insurance laws.

This insurance also protects your business from lawsuits because employees usually cannot sue you for injuries when coverage is in place. Understanding state insurance laws helps you stay compliant and safe.

Professional Liability / Errors & Omissions Insurance

Professional liability insurance, also known as errors and omissions insurance (E&O) or malpractice insurance, protects service-based businesses from mistakes, missed deadlines, or professional errors. It covers legal defense costs, settlements, and client disputes.

This coverage is important for consultants, real estate agents, accountants, marketers, and anyone offering expert services. It strengthens your risk management strategies and safeguards your reputation.

Additional Coverages Many Businesses Overlook

Many companies forget additional protections like cyber insurance, which helps with data breach response, cyberattacks and ransomware, and online threats. Commercial auto insurance protects business vehicles, while employment practices liability insurance (EPLI) covers wrongful termination or discrimination claims.

Other overlooked coverages include directors and officers insurance (D&O), product liability insurance, and umbrella insurance, which extends coverage limits. These are essential for full business assets protection and long-term safety.

How Much Does Small Business Insurance Cost?

Your business insurance cost depends on many factors including operations, revenue, claims history, and location. The factors affecting insurance cost include business size, risks, deductible amounts, and coverage limits.

Below is a simple table showing average insurance ranges:

| Coverage Type | Average Monthly Cost (USA) |

| General Liability | $40–$70 |

| Property Insurance | $60–$120 |

| BOP | $80–$150 |

| Workers’ Comp | $100–$250 |

| E&O | $60–$140 |

| Cyber Insurance | $80–$160 |

How To Choose the Right Insurance for Your Business

Choosing the right coverage begins with proper risk assessment, risk evaluation, and a full coverage review. Understanding your industry, employee needs, equipment, and customer interactions helps you select smarter options.

Working with an insurance broker or evaluating insurance rates comparison tools helps you choose insurers with strong stability. Always check AM Best rating to ensure financial strength and reliable claims service.

How To Get Business Insurance (Step-by-Step Guide)

The first step is gathering your business details, including revenue, employee count, equipment values, and past claims history. The next step is to compare insurance quotes from multiple insurers and review their insurance exclusions because hidden gaps can cost you later.

Once you select your provider, you sign documents, choose payment terms, and set up your policy. Make sure to perform a coverage review every year as your business grows.

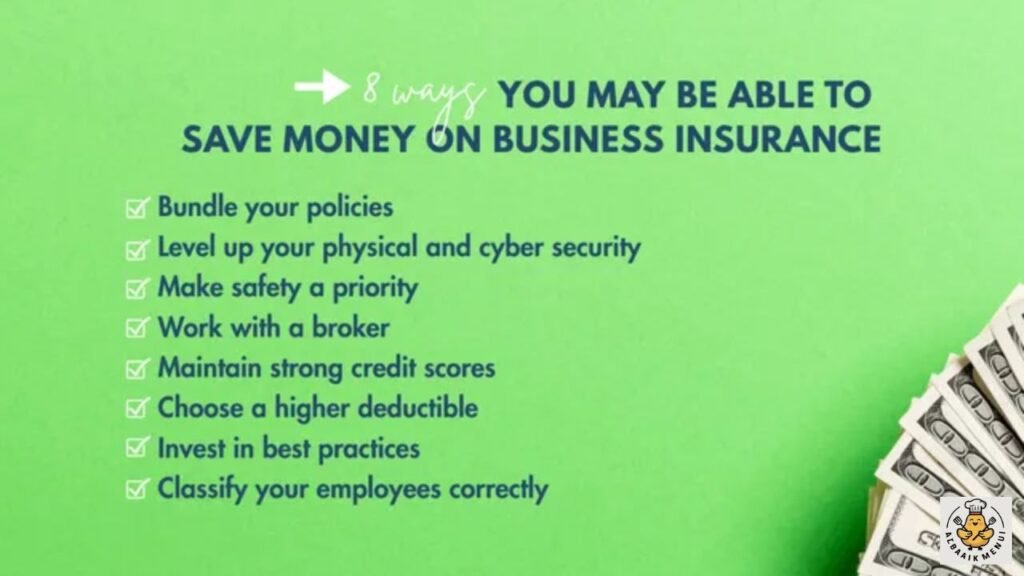

Best Ways To Save Money on Small Business Insurance

You can lower insurance premiums by improving loss prevention, creating strong safety programs, and upgrading business security systems. Cyber protection helps reduce cyber insurance costs through cybersecurity practices like secure passwords and employee training.

Other ways to save include choosing bundled insurance policies, using insurance discounts, and comparing multiple quotes during every renewal cycle.

Final Advice: Build a Protection Plan That Grows With Your Business

Your insurance plan should grow as your company expands. Start with essential coverages and add policies as your risks increase. Keep your emergency preparedness, business disaster recovery, and long-term risk management strategies updated to protect your investments.

A strong insurance strategy ensures long-term stability and confidence so your business can grow safely in every stage of success.

FAQs

1. What Insurance Do I Really Need for My Small Business?

This question helps readers understand the essential coverages based on risk, industry, and legal requirements. It is the most common search intent for beginners looking for guidance.

2. How Much Does Small Business Insurance Cost in the USA?

Cost is a major concern for new and growing businesses. This FAQ explains pricing factors, average premiums, and ways to save money.

3. How Do I Choose the Right Business Insurance Policy?

Many business owners need step-by-step advice on evaluating risks, comparing quotes, and selecting the best insurer or coverage options.

4. What Types of Business Insurance Are Available?

Business owners want to explore their options, including liability, property, workers’ comp, cyber, and professional liability coverages.

5. How Do I Get Business Insurance for My Company?

This FAQ covers how the process works, what documents are required, and how to connect with insurance brokers or online providers.